INSTRUCTIONS FOR COMPLETION OF PROVIDER ENROLLMENT FORM

All providers of child care services who wish to receive payment from the Department of Health and Human Services (DHHS) must be enrolled and are subject to all Department rules, regulations, policies, and procedures. This is done with completion of a child care enrollment packet. No payments will be made to any provider until the enrollment process has been completed. DHHS does not withhold tax money for individuals receiving payments for services. Payment of taxes is the responsibility of the individual.

Enrollment and Billing: At time of enrollment, all providers will be assigned a Resource Identification (ID) Number. A Provider Enrollment Notice will be sent informing you that the enrollment process has been completed.

Please retain this notice! The Provider Notice will give you the information required to be entered on all billing invoices that you submit to DHHS. To be reimbursed for child care services, you must bill on

DHHS billing invoice Form 2500.

Reporting Changes: Providers are required to report all changes to DHHS such as changes of address, incorporation, or provider name. Changes must be reported to DHHS by submitting them on a new FORM 2620 and ALTERNATE W-9 FORM to the address listed below. These two forms must be mailed together.

Form Completion

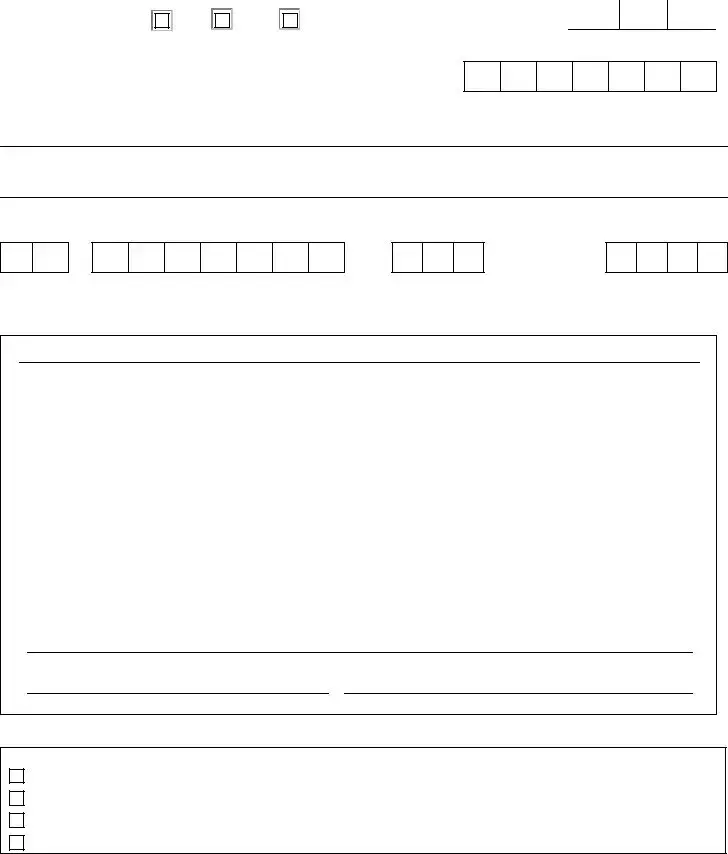

Transaction Code Add- Check when you request a new enrollment. Transaction Code Change- Check when you report a change, or are re-enrolling. Transaction Code Close- Check when you request to close your enrollment.

Resource ID Number- Enter your Resource ID number when you report a change or request an enrollment closing. Enter your number from left to right leaving unused spaces blank at the end.

Effective Date- Enter month, day, year. This date will be your first date of enrollment, date child care services will be provided by you, the effective date of your change, or your enrollment end date.

SECTION 1

Provider Name - This line must be completed whether you report income under your SSN# or EIN# Enter your own name here if you report income to the IRS under your Social Security Number.

Enter the name of your business here only if you report income to the IRS with an Employer Identification Number.

Doing Business As- Complete this line only if you report income to the IRS under your Social Security Number. If you have a business name, enter it. You must also indicate your first name, middle initial and last name on the line provided above.

Employer ID Number or Social Security Number- Enter the number you use to report income to the IRS (Enter only one number- either the SSN# or the EIN#).

SECTION 2

Provider Address- Enter your physical and billing or mailing address. (See note on the front of this form)

Contact Person- Enter the name, telephone number and email address of the person to contact for questions.

SECTION 3

Services Provided- Check the box for the child care service you provide.

Return this form, along with a completed ALTERNATE W-9 FORM, to the:

Department of Health and Human Services

Data Management Unit

Box 2000

Concord, NH 03302-2000