Free New Hampshire Reporting PDF Form

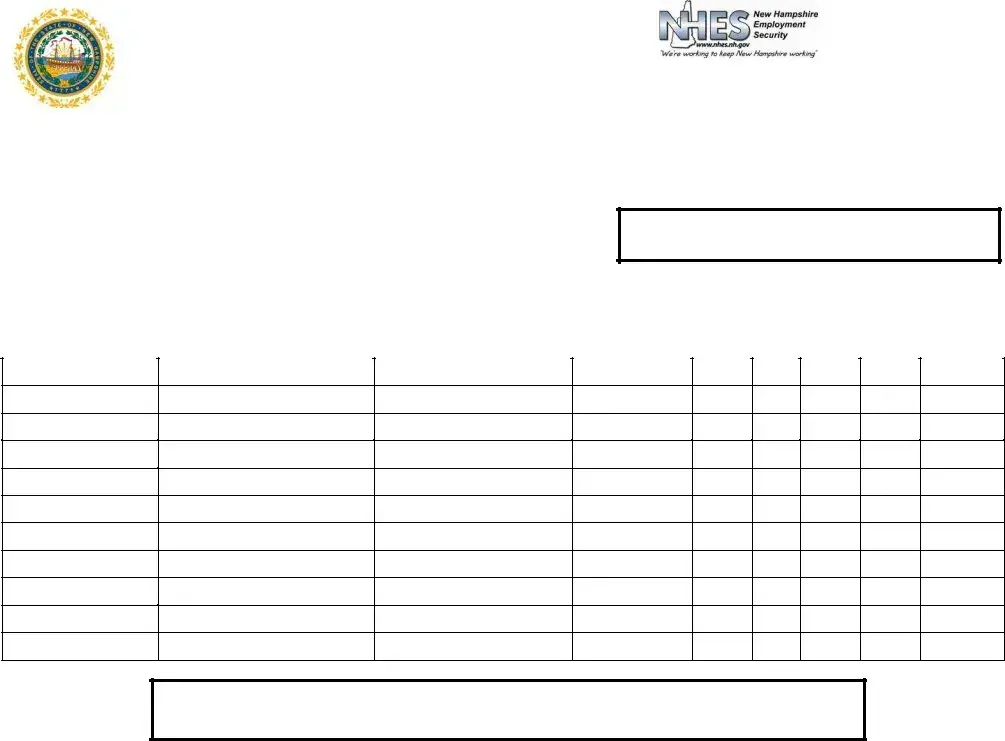

The New Hampshire Reporting Form is a document required for employers to report new hires to the New Hampshire Employment Security (NHES). This form includes essential information such as the employer's identification numbers, contact details, and specifics about the new employee. Timely submission of this form is crucial, as all new hires must be reported within 20 days of their start date.

Access New Hampshire Reporting Online

Free New Hampshire Reporting PDF Form

Access New Hampshire Reporting Online

This form still needs completion

Complete New Hampshire Reporting online — quick edits, easy saving, instant download.

Access New Hampshire Reporting Online

or

↓ PDF